In order to finance the development of tourism offer in its area of jurisdiction, the Community Council of the Communauté de communes du Vexin Normand has instituted the Tourist Tax on its territory since January 1, 2018. The community has opted for an actual tourist tax system, which applies to all overnight stays invoiced to tourist visitors and this, for all types of taxable accommodation.

The tourist tax is payable by any person not domiciled on the territory of the commune where he or she stays in accommodation occupied for consideration, in addition to the price of the accommodation, to the owner of the accommodation (or to the professional who provides the internet booking service on behalf of the accommodation provider). This fee is then paid to the Communauté de communes. The invoice given to the customer must clearly show the amount of the tax added to the price of the accommodation.

Every person not domiciled in the commune staying for a fee in a tourist accommodation (hotel, bed and breakfast, furnished accommodation or tourist residence, pitch and outdoor accommodation, any other rental including accommodation), is liable for the tourist tax for each night, in addition to the price of the accommodation.

The following are exempt from the tourist tax according to article L.2333-31 of the CGCT:

- Minors

- Holders of a seasonal employment contract employed on the territory of the local authority

- People benefiting from emergency accommodation or temporary rehousing

- People occupying premises where the rent is less than €20 per month.

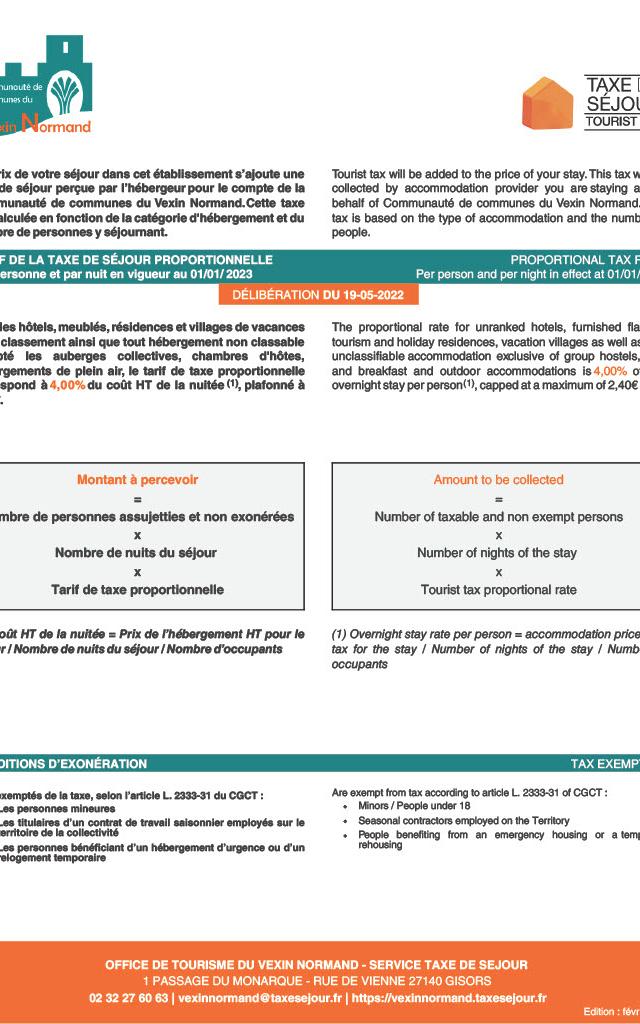

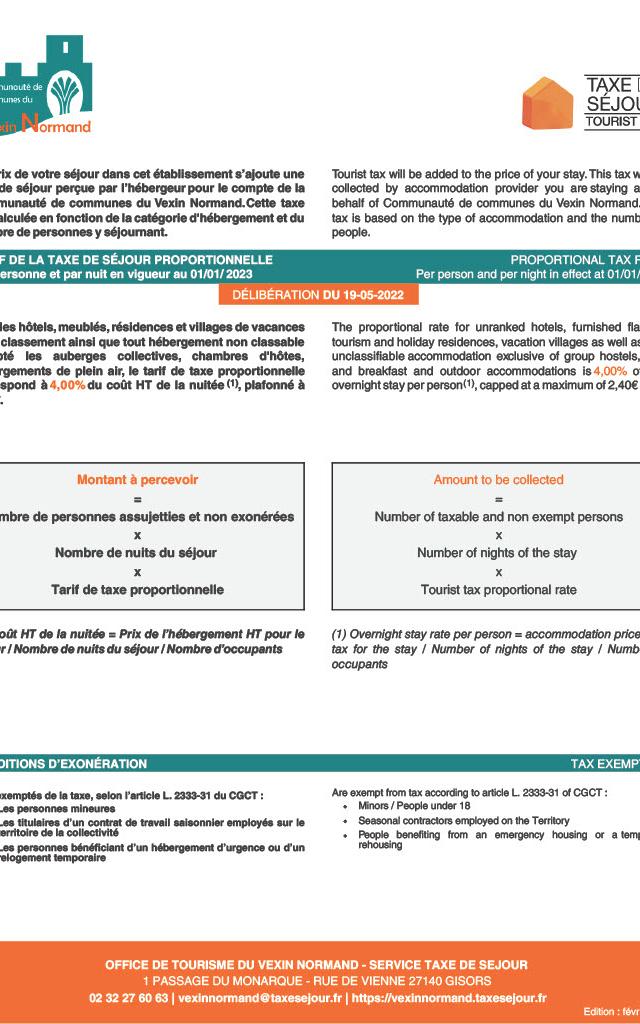

Rates Taxe De Sejour Fixes Cc Vexin Normand

Rates Taxe De Sejour Fixes Cc Vexin Normand Rates Proportional Taxe De Sejour Cc Vexin Normand

Rates Proportional Taxe De Sejour Cc Vexin Normand Parc Chateau De Gisors Ete 2022 Ml Vittori Vexin Normand Tourisme

Parc Chateau De Gisors Ete 2022 Ml Vittori Vexin Normand Tourisme Rates Taxe De Sejour Fixes Cc Vexin Normand

Rates Taxe De Sejour Fixes Cc Vexin Normand Rates Proportional Taxe De Sejour Cc Vexin Normand

Rates Proportional Taxe De Sejour Cc Vexin Normand